CA CD-100 2006-2024 free printable template

Show details

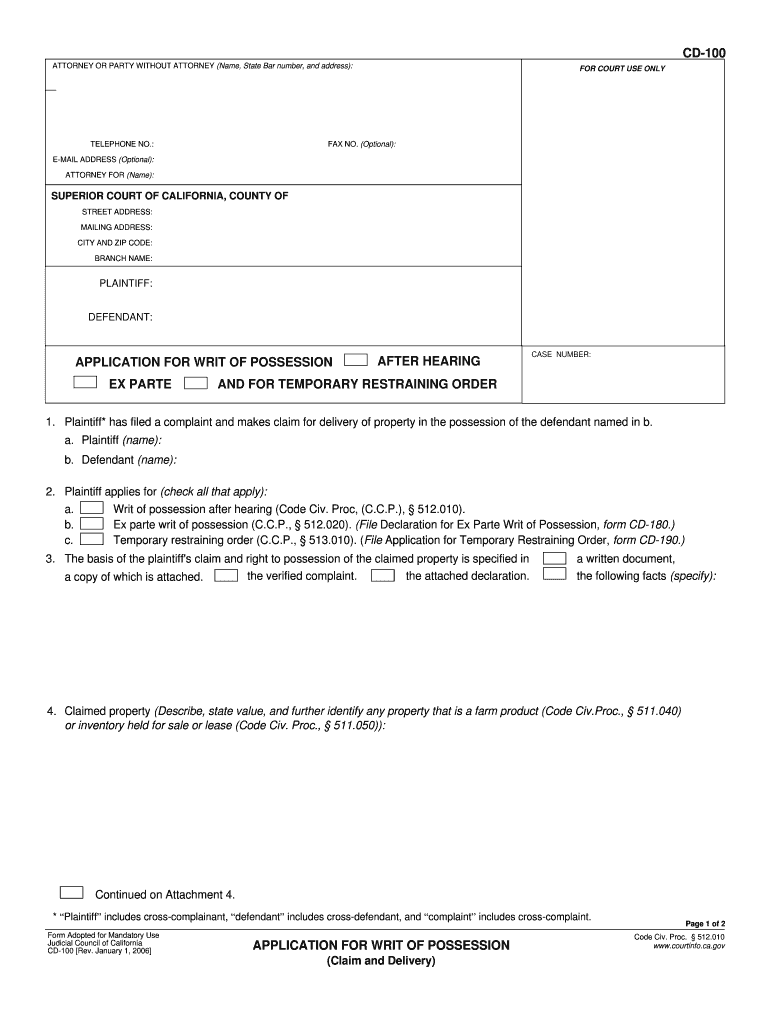

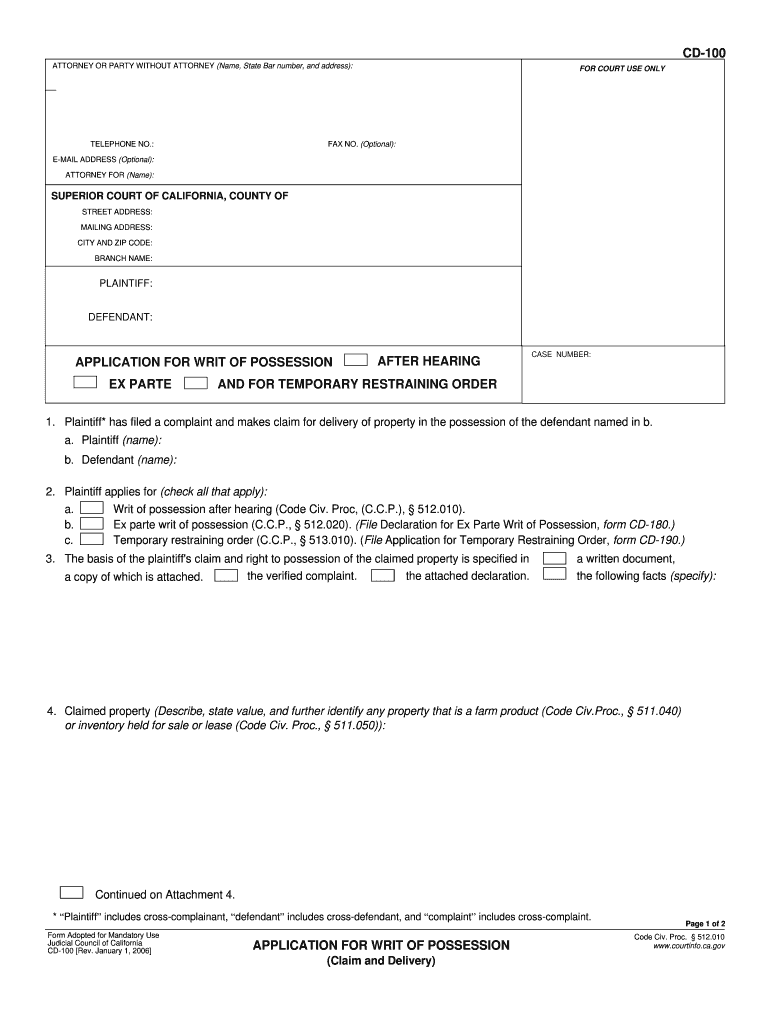

CD-100 ATTORNEY OR PARTY WITHOUT ATTORNEY Name State Bar number and address TELEPHONE NO. FOR COURT USE ONLY FAX NO. Optional To keep other people from seeing what you entered on your form please press the Clear This Form button at the end of the form when finished. E-MAIL ADDRESS Optional ATTORNEY FOR Name SUPERIOR COURT OF CALIFORNIA COUNTY OF STREET ADDRESS MAILING ADDRESS CITY AND ZIP CODE BRANCH NAME PLAINTIFF DEFENDANT APPLICATION FOR WRIT ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cd 100 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cd 100 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cd 100 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ca cd 100 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out cd 100 form

How to fill out cd100:

01

Start by gathering all necessary information such as personal details, relevant documents, and any supporting materials needed for the cd100 form.

02

Carefully read through the instructions provided on the form to ensure you understand each section and requirement.

03

Begin filling out the form section by section, providing accurate and complete information as requested. Double-check for any potential errors or mistakes before moving on.

04

Make sure to provide all required supporting documentation and attach them to the form as instructed.

05

Review the completed form and supporting documents thoroughly to ensure everything is correct and in order.

06

Sign and date the form as needed.

07

Submit the filled-out cd100 form and all supporting documents to the appropriate recipient or authority, following any additional instructions provided.

Who needs cd100:

01

Individuals or entities required to submit the cd100 form in compliance with a specific regulation, law, or procedure related to the particular jurisdiction or industry.

02

Anyone seeking to obtain a specific permit, license, certification, or authorization from a relevant governing body may be required to fill out the cd100 form.

03

Individuals or organizations involved in activities or transactions that necessitate accurate record-keeping and documentation, which the cd100 form provides.

Fill form cd100 : Try Risk Free

People Also Ask about cd 100

What is a writ of possession for personal property in California?

How do I get a writ of possession in California?

What is application for writ of possession California?

What is a writ of replevin in California?

What is a writ of possession of real property in California?

What is cd100?

What is the cause of action claim and delivery in California?

How do you get a writ of possession in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cd100?

CD100 refers to Cluster of Differentiation 100, also known as CD100 or Semaphorin 4D (SEMA4D). It is a protein involved in cell signaling and is typically found on the surface of various immune cells, including T cells and B cells. CD100 plays a role in axon guidance, neurodevelopment, and immune response regulation. It can interact with other cell surface receptors, such as plexins and CD72, to mediate its effects. Understanding the function of CD100 is important in various physiological and pathological processes.

Who is required to file cd100?

CD100 is not a specific form or tax requirement that is recognized universally. Without further information, it is not possible to determine who is required to file CD100.

How to fill out cd100?

CD100 is a form used for filing a claim for refund or payment of tax for cigarettes and/or tobacco products sold in California. Here are the steps to fill out the CD100 form correctly:

1. Obtain the CD100 form: You can download the form from the California Department of Tax and Fee Administration (CDTFA) website or request a copy by calling their helpline.

2. Complete the top portion of the form: Fill in your business or personal information in the designated fields, including your name, mailing address, phone number, and email address.

3. Enter the claim details: Provide the tax account number, filing period(s), and the amount of refund or payment you are claiming. Provide a brief explanation of why you are filing the claim (e.g., overpayment, credit balance, etc.).

4. Attach supporting documentation: Depending on the type of claim, certain supporting documents must be included. For example, if you are claiming a refund due to overpayment, you may need to attach copies of invoices, receipts, or other proof of payment. Ensure that the supporting documents are organized and clearly labeled.

5. Calculate the claimed refund/payment amount: This section requires you to provide detailed information about the claimed amount, including the amount to be refunded or paid, any adjustments or credits, and the net amount. Refer to the instructions provided with the form to ensure accurate calculations.

6. Signing and dating the form: The form must be signed and dated by the claimant or an authorized representative. If you are representing a business entity, you should clearly indicate your role and authority to sign on behalf of the entity.

7. Submitting the form: Make a copy of the completed form and all supporting documents for your records. Mail the original form to the address specified on the form or submit it electronically, if applicable. Be sure to retain proof of submission (e.g., certified mail receipt or confirmation email) for your records.

It is recommended to review the CD100 instructions and contact the CDTFA or consult a tax professional for any specific questions or clarifications while filling out the form.

What is the purpose of cd100?

CD100 is a type of gasoline additive that is used to enhance the performance of gasoline engines. Its purpose is to improve fuel efficiency, increase power output, reduce emissions, and prevent engine knocking. CD100 is formulated with various chemicals and compounds that help clean the engine's fuel system, remove deposits, lubricate key engine components, and improve the combustion process. This ultimately leads to better engine performance, improved fuel economy, and reduced environmental impact.

What information must be reported on cd100?

CD100 is a form used by banks to report Currency Transaction Reports (CTRs) to the Financial Crimes Enforcement Network (FinCEN). The purpose of CD100 is to document cash transactions that exceed $10,000 in a single day, conducted by individuals or entities, to detect and prevent money laundering and other financial crimes. The information that must be reported on CD100 includes:

1. Date of the transaction: The specific date on which the cash transaction took place.

2. Financial institution: The name and location of the bank or financial institution where the transaction occurred.

3. Customer information: The full name, address, and taxpayer identification number (TIN) or Social Security number (SSN) of the individual or entity conducting the transaction.

4. Type of account: Whether the transaction involves a personal account, business account, trust account, etc.

5. Currency details: The total amount of cash involved in the transaction, specifying the denominations of the currency (e.g., $100 bills, $50 bills, etc.).

6. Transaction type: The nature of the transaction, such as deposit, withdrawal, purchase, loan repayment, etc.

7. Reason for the transaction: A brief explanation of the purpose or reason for the cash transaction, such as salary payment, loan disbursement, business expense, etc.

8. Cash handling by third parties: If the transaction involved a third party assisting in the handling of cash, their name and contact information should be included.

9. Customized fields: Additional fields may be included on the form based on the bank's specific reporting requirements.

It is important to note that banks are required to file CD100 within 15 calendar days of the currency transaction.

How do I make changes in cd 100?

With pdfFiller, it's easy to make changes. Open your ca cd 100 form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in california writ possession without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing cd100 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete writ possession ex parte on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your california writ possession sample form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your cd 100 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Writ Possession is not the form you're looking for?Search for another form here.

Keywords relevant to ca application writ hearing ex parte form

Related to writ possession ex parte sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.